Chainlink (LINK) Breakout Imminent? Expert Insights

In the ongoing struggling cryptocurrency market, a prominent crypto expert shares a bullish outlook for Chainlink (LINK) and suggests that LINK could soon skyrocket in the coming days.

Chainlink (LINK) Price Prediction

In a post on X (Previously Twitter), the expert noted that LINK could break out from the ascending triangle in the next 1 to 2 weeks. Additionally, he further noted that LINK has the potential to reach $18 if the breakout successfully occurs.

LINK Technical Analysis and Upcoming Level

According to expert technical analysis, LINK has been forming an ascending triangle price action pattern since the beginning of August 2024, and now the price is moving slowly within a narrow range. However, looking at the LINK daily chart, it appears that the asset needs more time for the maturation of this pattern.

Despite this, if LINK breaks this resistance level or the neckline of the ascending triangle and closes a daily candle above $13, there is a strong possibility it could soar by 15% to reach the $15.5 level initially, and later $18 if the sentiment remains unchanged.

Current Price Momentum

As of now, LINK is trading near $11.07 and has experienced a price surge of over 4.5% in the past 24 hours. During the same period, its trading volume rose by 5%, suggesting growing participation from investors and traders compared to the previous days.

Despite this bullish outlook, LINK has been struggling to gain momentum for the past few days, and this struggle will continue until it breaches the $13 level.

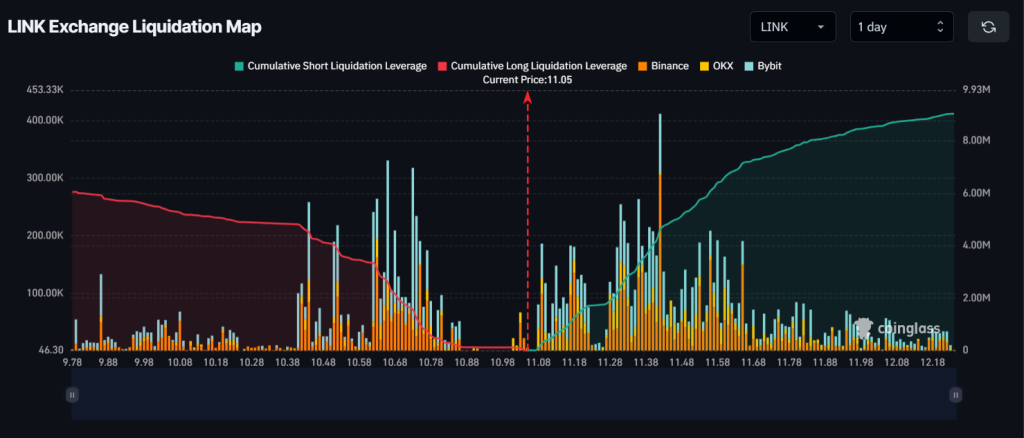

Major Liquidation Levels

As of now, the major liquidation levels are at $10.66 on the lower side and $11.42 on the upper side, with traders over-leveraged at these levels, according to the on-chain analytics firm Coinglass.

If this sentiment shifts and the price rises to the $11.42 level, nearly $4.62 million worth of short positions will be liquidated. Conversely, if the sentiment remains unchanged and the price drops to the $10.66 level, approximately $2.61 million worth of long positions will be liquidated.

This liquidation data shows that bears are currently dominating the asset, which may pose challenges for bulls attempting to experience an upside rally.